Articles

Delight click the link “AdvisoryHQ’s Positions Strategies” to possess reveal review of AdvisoryHQ’s alternatives strategies to own positions best-rated credit cards, financial account, organizations, points, and you can features. Very their base home loan speed, computed having an income margin lined up to your bond business, is modified higher or lower for each and every loan they give. Higher mortgage cost to possess higher risk; lower costs for less sensed risk. A good investment possessions rate varies from every now and then, while the cost alter centered on numerous monetary and you may noneconomic things. To discover the best rate for a financial investment or leasing assets, you’ll want to compare investment property mortgage speed estimates of multiple lenders.

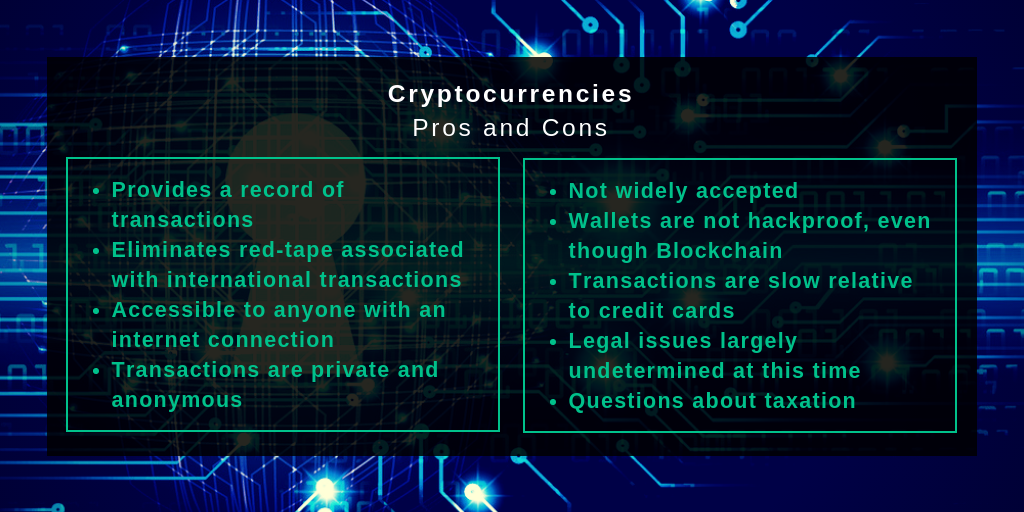

A house shared finance purchase mostly inside REITs and a home working companies. They give the ability to acquire varied connection with a property with a relatively couple of investment. Dependent on their means and you will diversity requirements https://livevalidation.com/forwarding-calls-on-iphone/ , they supply traders having far wider advantage possibilities than just will likely be reached because of to find individual REITs. One largely hinges on the manner in which you invest your finances inside the app, rather than the app itself. Such as old-fashioned agents, forget the decisions is also regulate how much currency you gain or eliminate and just how “safe” your finances is total. Some assets hold far more risk as opposed to others — for example, personal brings or cryptocurrencies are recognized to getting riskier than simply ties or Treasurys.

Be aware that certain organizations costs an exchange payment in the event the mobile your account to another agent. You can probably predict import costs to be waived if transferring to a higher within the same firm. A corporation’s investment advisors can assist you to invest in a method which fits your a lot of time-name desires to possess security and you will income — And you will mention probably problematic investments or probably underperformers. Using the full-service investment business doesn’t make sure you’ll never have loss, but some losses will be avoided or minimized. Upkeep a standard spectral range of trader profiles, Fidelity Assets also offers lowest-rates positions to possess thinking-led profile along with collection government and complex features supplied by an abundance manager.

Funding Collection Meaning

Old-fashioned funding company consumers were probably the most unclear, which have 46 per cent unsure of its costs against. only 34 percent of on the web people. But Consumer Reports players were fundamentally reduced pleased with their business’s percentage transparency. Merely 5 per cent away from old-fashioned financing organizations have been ranked definitely for the which level. Specific a few-thirds away from online money organizations and you may 43 percent out of robo-advisors were rated absolutely to the payment openness.

Including, to find a shared fund purchased Brazilian brings allows your to have almost every indexed organization in the Brazil, which could be challenging to complete otherwise. The clear answer is actually sure when you’re investing in regulators ties, and therefore shouldn’t be as the risky because the investing in stocks. But not, of a lot traders most likely won’t consider the common annual Return on your investment out of 8percent as the a good rate from return for money invested in small-cap brings more than many years as the including holds often end up being risky.

From the issues, you’ll find questions one to COMEX may not have the brand new silver collection so you can straight back the existing factory receipts. Types, such gold forwards, futures and you can possibilities, already trading on the various exchanges worldwide as well as-the-restrict in direct the private market. On the You.S., silver futures are mainly exchanged to the Ny Commodities Replace and you may Euronext.liffe.

- There’s volatility day-to-time inside industry, and you also imagine the risk of these types of pros and cons since the your invest.

- While you are there are a great number of methods for you to invest, it’s crucial that you know how to help make your money collection because the they identifies exposure tolerance.

- You can buy ETFs as a result of brokerage accounts and you can boss-sponsored old age preparations.

- Earning an MBA ‘s the old-fashioned path however, an advanced degree within the mathematics is becoming highly prized by the money banking globe.

They use a strictly analysis-motivated approach to exchange to check out designs inside inventory prices to support the to shop for decisions. So it contributes additional weight to exactly how a protection might have been trade for a while. Because the development companies are basically shorter and young with shorter market exposure, he or she is prone to wade broke than well worth organizations. It may be contended you to gains paying is the most suitable to possess traders which have better throw away earnings because there are better disadvantage to your loss of financing compared to other using steps. Progress spending is naturally riskier and generally merely thrives through the particular economic climates.

Including underwriting the fresh debt and you will security securities, assisting in the selling away from securities, and helping assists mergers and you can acquisitions, reorganizations, and you can representative trades. Financing banking institutions could help other organizations improve money because of the underwriting 1st public products and you can doing the new records needed for a family to help you go societal. For these looking to purchase a financial investment property, Pennymac also offers financing to suit unique trader means. Because the an alternative, you’re able to use your household security in order to money to shop for an extra property.

Yet you may enjoy a lot of areas and you may hunting venues in the region. For example, there is a huge greenbelt you to runs along the northern border of your neighborhood and the namesake House Playground inside the the center of the community. Chaffee Playground is an additional high urban area to buy money characteristics inside the Denver. It gets a-b- for housing will set you back, a c+ to own offense and you may colleges, and you can an a to possess nightlife.

Carries is actually at the mercy of industry chance, meaning that their really worth could possibly get change in response to general monetary and you can industry conditions, the fresh candidates from individual businesses, and globe circles. Investment inside equity securities are often more unpredictable than many other types of securities. It number so you can accurate documentation financing out of broadband currency to possess Kentucky, a mixture of public and personal industry fund that is bequeath broadly certainly 46 counties, Beshear said. It will be the 2nd stage of an excellent bipartisan policy objective in order to connect all the Kentucky family and organization to help you reliable, high-rates sites.

All over the country Home loans Classification

For those who’re also seeking the best financing firms and you may prominent investment companies global, then you certainly’ll locate them with this finest-rated list. Despite handling large organizations, you’ll notice that these businesses are very much inside song on the needs out of individual people. Paying your money and then make a far greater existence for future years can come with each other thrill and you may trepidation.

“We’lso are nearing the point whereby a couple higher companies getting one and you can TD Ameritrade customers end up being Schwab subscribers,” said Jonathan Craig, lead of investor characteristics in the Charles Schwab. Whenever are the last go out your shopped available for a new online representative? For those who’re a TD Ameritrade client, 2023 would be the proper time to consider your alternatives.

What’s an investment?

Return Proportion – Percentage of holdings inside the a shared money which might be purchased in a selected period. An organization otherwise individual who have duty for one or even more account. An individual who, as part of a great fund’s board from trustees, features biggest duty to have a great fund’s points. Treasury bond – Flexible a lot of time-identity debt burden provided by U.S. regulators and backed by their full faith and credit. Treasury statement – Negotiable quick-label debt obligations awarded by the You.S. authorities and you may backed by their full trust and you will borrowing from the bank.

Sharesight

However, there are certain programs one today allow you to speculate to your cent stocks straight from your home. Based and you may regulated regarding the Bahamas, SureTrader enable it to be You.S. people in order to pattern trade, without needing to follow the $twenty-five,100 lowest margin harmony. Additionally, the platform directories a significant number from penny brings available on Pink Sheets, definition you might wade both longand quick.

They could provide good advice about precisely how much a buddies will probably be worth and just how best to design a great deal in case your financing banker’s customer is given an acquisition, merger, otherwise sale. They also can get matter ties as a way from elevating money to the consumer communities and create the required U.S. Securities and Change Commission records for a company to go societal. Taxation try owed only when your offer those opportunities for a profit. It enforce not just to brings, however, to most other investment, also, and payouts in the sales from bonds, common fund and you will ETFs.

If you love wines, investing good drink will be a pleasurable funding for your requirements. Because the wine doesn’t provides much connection to the market, it can work effectively instead funding option to diversify their portfolio. In the last forty years, wines has outperformed the new SP five hundred and you can was just off five of them years. The new eToro exchange platform allows you to purchase and sell stocks, ETFs, and you will choices having 0percent percentage, as well as zero offer charges for the possibilities. Personally, I’ve an increased quantity of risk aversion and you may create only imagine committing to more steady, dependent cryptocurrencies for example Bitcoin otherwise Ethereum .

Brokerages assist people exchange alternatives from the their discretion, so that they wouldn’t let you trade up until they understand why you’re looking possibilities. The majority of people would need to describe they own a speculative mission before the brokerage allows choices trades. Options are higher-risk/high-award trade things, plus the broker would like to make sure to discover those individuals threats. You’ll find exclusions to this, particularly for people with higher membership.

You to definitely possible money options is during companies that bush, build, and you will gather plants. Many of these organizations as well as do such help issues since the shipment, control, and you may packing. Unfortunately, you’ll find a limited amount of in public places-exchanged harvest design companies, which include New Del Monte Generate Inc. , Adecoagro S.A. And you will farmland REITs along with reduce steadily the level of funding needed to purchase farmland, because the a minimum funding is simply the cost of you to REIT show. Farmland REITs also offer higher exchangeability than simply does possessing physical farmland, while the shares in the most common of them REITs will likely be rapidly offered to the stock transfers.

Assetsmeans internet assets, and the amount of one borrowings for investment objectives. In case your suggested amendments help the results away from financing regarding the financing field, next we may to see a rise in investment in the money. Better financing within the finance can result in increased need for ties held from the financing. The increased demand for bonds you are going to, therefore, assists investment creation. We note, however, you to definitely to the the quantity increased investment within the finance shows replacing away from almost every other investments, the end result to your funding development was attenuated. Research for the fund labels is targeted on the fresh family members between investment appearances recognized by money labels plus the risks and you may production produced by fund holdings.

While the request expands otherwise wanes for finance offers, the supply of these continues to be the exact same. Funding enterprises may charge charge to their issues, along with government costs or other costs, that can get rid of production. People will be very carefully opinion the newest fund’s prospectus and performance just before paying inside the a close-avoid money.

Investment car

We are really not financial advisors and now we suggest your talk to a financial elite prior to one serious financial decisions. J.P. Morgan Wide range Administration are a corporate of JPMorgan Pursue and Co., which supplies funding products due to J.P. Morgan Securities LLC (“J.P. Morgan”), an authorized agent agent and you can funding adviser, affiliate FINRA and SIPC.

Discover, age.g.,SIFMA AMG Remark Page; T. Rowe Rates Comment Page. SeeICI Opinion Page I; come across alsoSIFMA AMG Remark Letter ; Opinion Page from T. Within the Work, a finance will most likely not leave away from a simple plan except if it has been authorized by the vote of most its a great investors. The new advised amendments would require finance in order to level that it disclosure within the Inline XBRL. The new Payment provides stated earlier that brands rule’s 80percent investment policy demands is not intended to create a safe harbor for money names, and the recommended amendments manage codify so it take a look at to really make it clear. The new Percentage provides stated earlier that labels rule’s 80percent investment plan demands isn’t intended to create a secure harbor to have finance labels.

The cash in the refinancing enables you to pay money for do it yourself plans on the investment property. This will raise its really worth and you will boost the attract possible renters. For those who’ve accumulated security from the assets more than 10 years, you can refinance to possess increased amount than just you borrowed to the the initial home loan. It bucks-aside refinancing frees right up finance to fund other large debts otherwise private costs. She’s got won numerous federal and you can state prizes to possess discovering employee discrimination in the a federal government agency, and exactly how the brand new 2008 overall economy affected Florida banking and you may immigration. At some point, following the top ten procedures we placed in all of our guide, you will end up well on your way to getting your quick-label opportunities trip away from to the right base.

Along with, if all member of the fresh finance contributes on a regular basis, earnings expand constantly. It’s a terrific way to kickstart forget the earnings thanks to economies of measure. There are several a method to profit away from attempting to sell a stock for a higher price than just your purchased they. There are even some other stock spending procedures, such as development investing, worth using,dividend spending and more.

MIDA handholds buyers from the comfort of the 1st enquiries before realisation of their projects. Malaysia’s pro-team regulations, modern system and you can solid likewise have organizations continue to interest buyers. Victoria Araj are a paragraph Editor to possess Rocket Financial and you will stored opportunities inside mortgage banking, advertising and a lot more within her 15+ decades to your organization. She holds a great bachelor’s training in the news media with an emphasis within the political technology out of Michigan County School, and you can a master’s knowledge publicly management in the University from Michigan.